What is an NFT – and should you be adding one to your art collection?

“NFTs are going to upend the art system as much as Bitcoin and Ethereum are going to change the financial landscape.”

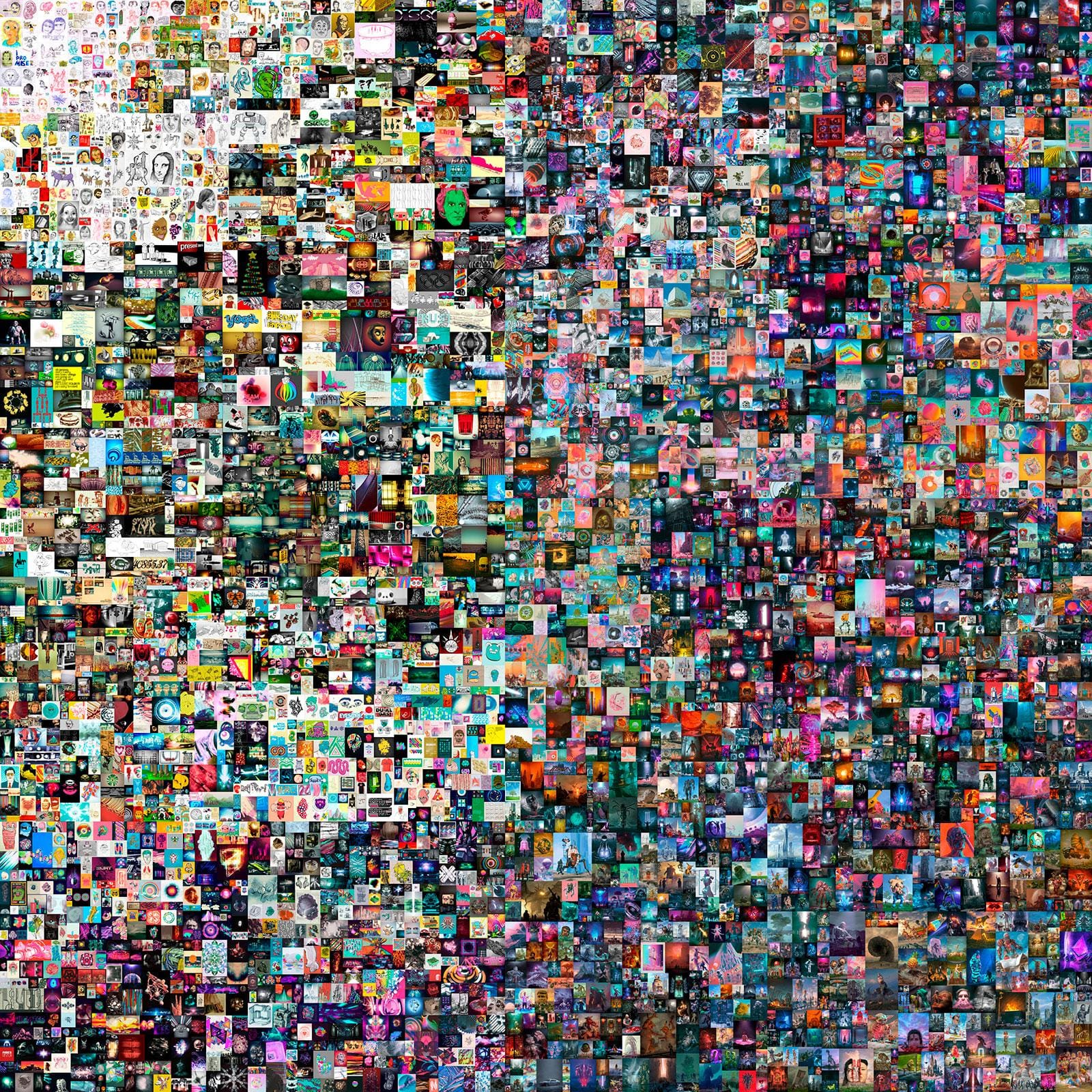

On 11 March 2021, 24 hours after this article was commissioned, Mike Winkelmann – better known by his online moniker Beeple – sold his digital artwork First 5,000 Days via an online Christie’s auction for $69.3 million. The third highest amount ever paid for an artwork by a living artist.

It’s worth noting that this sale came after months of increasingly valuable digital art auctions. In October, Winkelmann sold his first series of NFTs, with a pair going for $66,666.66 each. In December, he sold a series of works for $3.5 million total. And, last month, one of the NFTs that originally sold for $66,666.66 was resold for $6.6 million.

A few factors explain why Beeple’s work has become so valuable. For one, he’s developed a large fan base, with around 2.5 million followers across social channels. He’s also famously prolific: as part of a project called Everydays, Winkelmann creates and publishes a new digital artwork every day. The project is now in its thirteenth year, meaning there are over 5,000 pieces in the series.

There is also the fact that there are some very wealthy players who believe in the value of NFTs. A few days after the Christie’s auction it was revealed that Metakovan, the pseudonymous founder and financier of Metapurse, the largest NFT (unique digital assets) fund in the world, was the successful bidder. Speaking on the purchase, he explained, “When you think of high-valued NFTs, this one is going to be pretty hard to beat. And here’s why – it represents 13 years of everyday work. Techniques are replicable and skill is surpassable, but the only thing you can’t hack digitally is time. This is the crown jewel, the most valuable piece of art for this generation. It is worth $1 billion.”

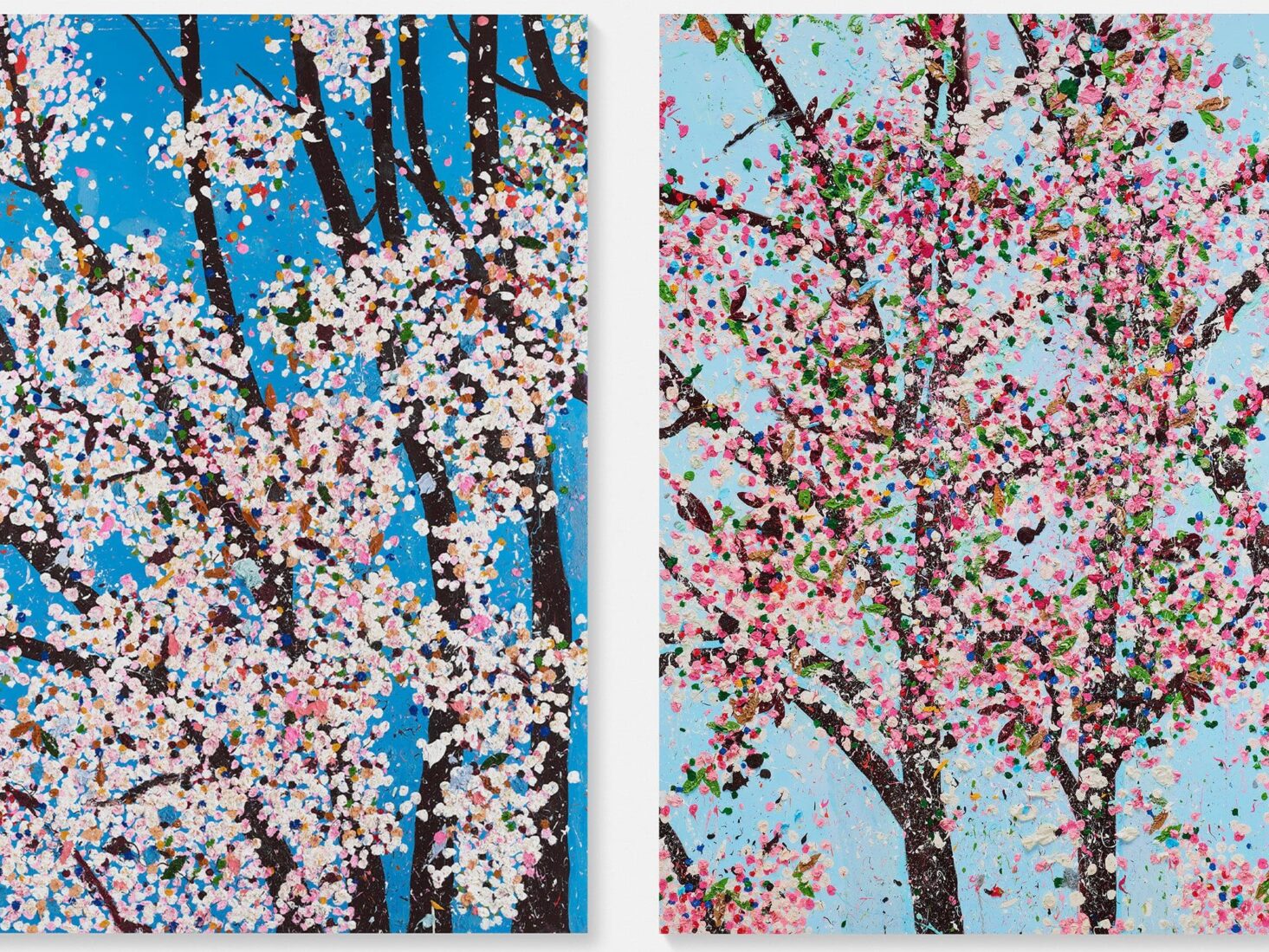

But Beeple is not the only artist exploring the digital field. Damien Hirst, too, recently sold a time-based open edition series of prints for $22.4 million and revealed he was going to launch a secret NFT art project called Currency that has been in the works for five years.

“Ever since I made the diamond skull I’ve been thinking about wealth and value,” he explained. “I have been working on an artwork for the last five years. It’s been blowing my mind. It explores and challenges the concept of value through money and art. For the past three years the project has been expanding into the blockchain and NFTs.

“It involves 10,000 original works of art on paper, which I call “The Currency”. I made them all five years ago, and they are in a vault but about to come to life through their launch on the blockchain. They also exist as NFTs and a related cryptocurrency. The whole project is an artwork, and anyone who buys “The Currency” will participate in this work, it’s not just about owning it. It is the most exciting project I have ever worked on by far.”

With some serious names and money behind it, the market for NFTs is booming, with new records seemingly being set on a semi-regular basis. But what actually are NFTs, why is this happening now and is this an art world bubble or an investment to be taken seriously?

|  |

What is an NFT?

NFTs allow you to buy and sell ownership of unique digital items and keep track of who owns them using the blockchain. NFT stands for ‘non-fungible token’, and it can technically contain anything digital, including drawings, animated GIFs, songs, or items in video games. An NFT can either be one-of-a-kind, like a real-life painting, or one copy of many, like print editions, but the blockchain keeps track of who has ownership of each unique file. In essence an NFT proves that the digital artwork you bought is unique or from a short run: it proves scarcity.

NFTs have been making headlines lately, with some selling for millions of dollars, and high-profile memes like Nyan Cat and the “deal with it” sunglasses being put up for auction. NFT sales have been particularly headline-grabbing because, in most cases, the images, songs or memes they contain can be already be seen by anyone on the internet for free. An NFT, then is not about the pleasure of enjoying something that no-one else has access to but about owning a unique version of something already enjoyed by the masses.

So why now?

As with most market booms of this nature, there are a few forces at work here. The Covid-19 pandemic has forced collectors to look at physical art online at virtual versions of art fairs, such as Art Basel, Frieze, and on the websites of top galleries. The reality is, however, that in this setting most art doesn’t look great. It doesn’t excite.

Of course it doesn’t, it wasn’t created for this medium, it was created to be seen in a gallery space, contemplated, understood over time. What this phenomenon has done, however, with the help of publicists from galleries, art fairs and auction houses, is legitimise the purchase of expensive, high-level art online.

It is almost inevitable, then, that after looking at oil paintings in 3D reconstructions of real world spaces, buyers going to platforms selling NFT editions and seeing art that has been created specifically for that medium are impressed. The art is in your face, fun, bright, noisy, quick. It’s new world, not old world.

There is also the fact that the NFT market has opened up a new world of art to many who shunned it in its more traditional guise. There are a lot of people with crypto wealth, or who have made a lot of money from cryptocurrency, that simply feel more comfortable in the digital space. There were only 33 active bidders in the Beeple auction and, according to the auction house, 20 of these had never bid at Christie’s before.

The last, and possibly most important factor, is trust. I was first contacted in November about NFTs becoming a thing and, since then, there has been a concerted effort by people in the industry to have them accepted by well-known galleries and auction houses as a mechanism to instill trust in potential buyers.

Of course, that has now happened. We’ve had the big galleries, auction houses and experts telling us it’s okay to buy art online, we’ve seen that art created for the medium is better than art that hasn’t been created for it and people have started buying it. The final part of the jigsaw is the NFT technology itself; it guarantees exclusivity, scarcity and value. Plus, if someone is willing to pay $69+ million, it must be okay mustn’t it?

Are NFTs worth investing in?

I’ll start with another quote, this time from Keld Van Schreven, an art collector and co-founder of KR1 Europe, the continent’s leading digital assets investment company. “NFTs are a very interesting option for art collectors as you are buying and investing in a new revolution as well as the art itself. NFTs are going to upend the art system as much as Bitcoin and Ethereum are going to change the financial landscape.

“Once you have bought an NFT, reselling the work you have bought couldn’t be easier. There are several markets that you can buy and sell NFTs on and they have good liquidity. NFTs completely disintermediate the gallery system. NFTs are a game changer for artists as well as collectors as they give artists new liquidity as well as a tamper proof storage medium with automatic royalties on future sales.”

As Van Schreven points out, one of the problems with the existing art world is the difficulty of selling your art. Selling quickly or flipping is frowned upon and artists don’t get a cut of the resale price in most cases. Finally gatekeepers at the big galleries restrict access to prime artists and sell to their top collectors and friends first. The NFT art market does away with these traditional controls just as cryptocurrency does with established currency.

Like all investments, however, you need to research the market. Not all platforms selling NFTs are as safe or reliable as others. Commission rates are high, in some cases 5%, while there have been cases of people selling other people’s art as their own and the theft of ‘wallets’ containing NFTs and cryptocurrency. Just as if you were buying a Rembrandt, if you’re going to get into the NFT market, you need good tech and security.

Potential investors, however, shouldn’t be deterred. There are 4-5 well known and well managed NFT art trading platforms, such as Nifty Gateway, Super Rare and Foundation, and if you stick to those most of these issues should be covered. The market is also very transparent. You can see previous trading data for individual works, artists and, even more helpfully, collectors. If you still aren’t sure, you can even do as one interested collector recommended and invest in Ethereum: the ‘currency’ on which all these NFT’s are minted.